The US accommodation market is iconic. It’s 1950’s motels lining empty desert roads, sun-soaked Miami beach resorts, old-world luxury with park views and much more besides. No wonder the US is the world’s largest tourism market and its third most visited destination.

Even after 3 years of pandemic shutdowns and restrictions, hospitality entrepreneurs remain resilient. Due to increasing consumer demand, many are expecting 2023 to be their best year yet. The market remains dynamic and diverse, providing an unprecedented mix of lodging options for eager travelers. Whether looking for the amenities of a chain hotel, the uniqueness of a boutique property, or the local feel of a vacation rental, there is truly something for everyone.

As we see in almost all sectors, however, the US accommodation market is undergoing a process of “chainification.” Just as you could enjoy the same burger in Honolulu or Boston, so too could you find an almost identical hotel experience. Recent estimates show that branded properties make up more than seven in 10 hotels in the US. This trend was exacerbated by the pandemic, when travelers gravitated toward the perceived safety of well-known brands. According to Tourism Economics, 29% of US hotel guests stayed at independent hotels in 2021, compared to 46% in 2019.

A few factors could be at play. For one, small and mid-sized properties struggle to match the major brands when it comes to marketing spend and reach. Sole proprietors and hospitality entrepreneurs alike have limited resources (and there are so many hours in the day!), thus, they must prioritize. Understandably, guest experiences and amenities will often trump the need for revenue management systems or analytics, for example.

A mixed marketplace of chain and independent hotels is the goal, but often independent hotels are at a structural disadvantage that makes it difficult to compete. While there is a place in the market for all hotel types, and chains have their benefits (familiarity, consistency, price), we are beginning to see a lopsided marketplace. Here we focus on the US market, but this is a phenomenon that we see across the world. In the UK and Ireland, for instance, the market for independent hotels shrank by roughly 12% between 2010 and 2019.

Online platforms can help to address the imbalance, empowering small and independent properties to maintain or improve their competitiveness. There are three key areas to consider:

Online travel agencies (OTAs) process millions of bookings from across the world daily. Like branded hotels, they are trusted names who travelers know they can rely on. For independent hotels, this name-recognition can be useful in reaching customers who are potentially outside of their typical sourcing market.

While, according to Phocuswright, online platforms represent just one-fifth of total bookings — offline travel agencies, offline direct (walk-in/phone) and online direct (websites/apps) representing the majority — they can attract guests who are perhaps unfamiliar with their destination or who will benefit from features such as automatic website translation, 24-hour customer support or frictionless payment options. As Peter O’Connor, Professor of Strategy at the University of South Australia Business School, explains:

“OTAs… reduce the technical and administrative hurdles of online distribution, taking care of issues such as translation, credit card processing and search engine marketing.”

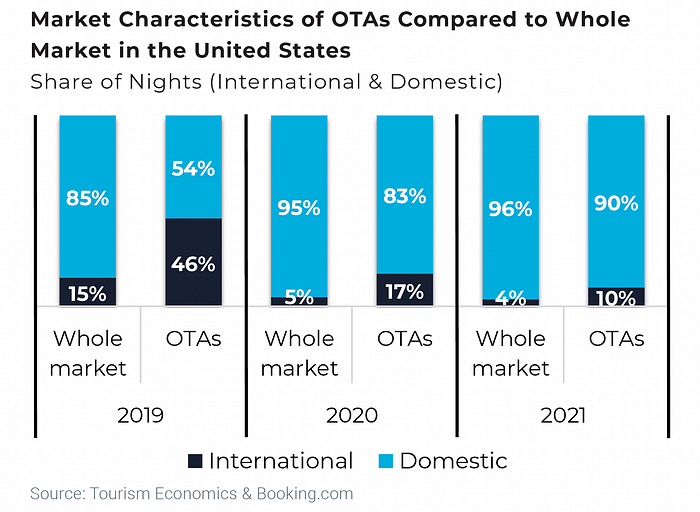

While COVID-19 and subsequent restrictions impacted demand from international travelers, that is all about to change. According to Tourism Economics, 46% of online platform room nights were from international travelers in the US in 2019. Although that percentage shrank to 17% in 2020, international borders reopening means numbers have come roaring back. The National Travel and Tourism Office (NTTO) forecasts 11 million more passengers entering the US in 2023 compared to the prior year, reaching 62.8 million visitors. Online platforms can help connect these travel-hungry international guests with their perfect match in the US travel market.

As shown in the Phocuswright’s US Consumer Travel Report 2022, most users of an online travel platform are not completely loyal to a particular hotel brand and are constantly looking for the best value and location for their needs. Travelers use digital platforms because they are convenient, easy to use, and often offer the best price. For no upfront cost (no fee is taken until after a room is sold), independent properties, who choose to partner with online platforms, can get global visibility along with the international chains as travelers put together the itineraries for their trips.

No loyalty program? No problem. While most chain hotels offer loyalty programs that reward frequent travelers (with points for future travel or other perks), most independent lodgings choose not to, as it may not be practical for a property of their size. Online travel agencies, however, have their own offerings to attract repeat usage, which benefits both hotel partners and consumers. Such programs have grown significantly over the past few years: Now one in five travelers participate in one.

A former Professor of Marketing at Cornell’s School of Hotel Administration, Bill Carroll makes a convincing argument that online travel agencies generate value for partner properties of all sizes by delivering incremental customers (e.g. with no brand loyalty) whom those hotels would, otherwise, be unlikely to get.

While chains have made big investments in technology powering revenue management, personalization and forecasting, many independent properties don’t have that luxury. According to a recent OTA Insights survey of independent hoteliers, many hotels are still lacking systems for pricing, marketing and distribution. Nearly half do not have a revenue management system and roughly three quarters do not have a marketing platform.

Instead, small and mid-sized properties can make use of the data and analytics features offered for free by their online partners, giving them visibility into consumer preferences and future demand, to help them make informed decisions around pricing or allocating inventory. According to Mr. Carroll, “Hotels can use [online travel agency data] to better evaluate the impact of their OTA partnerships and make better decisions regarding rates and promotions, shifting incremental demand as the market fluctuates.”

Online travel agencies empower small and mid-sized independent accommodation providers in need of greater visibility, and, according to recent research, the benefits outweigh the transaction costs. A recent analysis indicated that online travel agency participation boosts profitability and proves “net positive” for hotels, particularly for smaller properties that tend to be owned and managed by a sole proprietor. A Tourism Economics analysis of online travel agency impact on average daily rate (ADR) by segment also found a stronger relationship between online travel agency usage and ADR for independent hotels over chain properties.

The bottom line is that in the US, where independent properties are in the minority and often at a structural disadvantage, online travel platforms are increasingly useful to reach global customer base. Independent properties have lots of ways to sell their rooms; what online platforms represent are a tool with which to leverage extra stays and engage customers who may otherwise may not have found them. The end result? Happy guests, happy providers, and a travel market that retains its singular charm.